What Does Ach Payment Solution Do?

In enhancement, an ACH repayment can be much more safe and secure than other kinds of payment. Sending out and receiving ACH payments is generally fast.

ACH transfers are generally fast, typically cost-free, and also can be more easy to use than writing a check or paying a costs with a credit score or debit card. An additional advantage is that ACH transfers are frequently free, depending on where you bank as well as the kind of transfer entailed. Your financial institution might charge you absolutely nothing to move money from your checking account to an account at a various financial institution.

9 Easy Facts About Ach Payment Solution Shown

Cord transfers are recognized for their rate as well as are typically made use of for same-day solution, but they can occasionally take longer to complete., for circumstances, it might take numerous organization days for the money to move from one account to one more, then one more couple of days for the transfer to clear.

There are some possible disadvantages to bear in mind when using them to relocate cash from one bank to one more, send out payments, or pay expenses. Many banks impose limitations on how much money you can send out through an ACH transfer. There might be per-transaction limitations, daily restrictions, and monthly or regular restrictions.

Or one type of ACH transaction might be endless but one more might not. Banks can likewise impose restrictions on transfer locations. If you go over that restriction with multiple ACH transfers from financial savings to an additional financial institution, you might be hit with an excess withdrawal charge.

When you pick to send an ACH transfer, the time framework issues. That's since not every bank sends them for financial institution handling at the exact same time. There might be a cutoff time through which you require to get your transfer in to have it refined for the following business day.

The Best Strategy To Use For Ach Payment Solution

Same-Day ACH processing is expanding in order to address the sluggish service of the standard ACH system (ach payment solution). Same-Day ACH volume rose by 73.

These services allow you to send out cash online as well as pay bills by establishing an account and also linking it up to your credit report or debit card. Keep in mind, however, that these companies commonly charge a cost. The most significant benefit of these apps, besides being simple to utilize, is the rate they can provide for transfers.

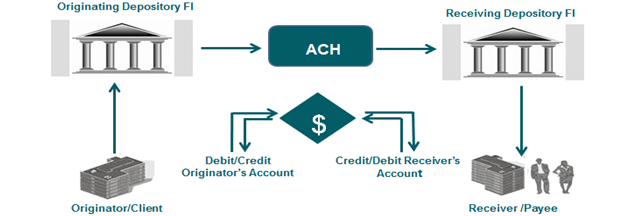

An see post ACH financial institution transfer is a digital payment made between financial institutions for repayment purposes. ACH bank transfers are made use of for several purposes, such as straight down payments of paychecks, financial debts for regular repayments, and money transfers.

Ach Payment Solution - Questions

In any case, make certain you recognize your bank's plans for ACH straight down payments and also straight settlements. Be vigilant for ACH transfer scams. A common scam, for example, involves somebody sending you an email informing you that you're owed money, as well as all you need to do to get it is give your bank account number and transmitting number.

Editor's note: This write-up was first released April 29, 2020 as well as last updated January 13, 2022 ACH represents Automated Clearing Home, a united state economic network used for digital settlements and cash look at this website transfers. Likewise called "straight repayments," ACH settlements are a method to move money from one financial institution account to one more without utilizing paper checks, bank card networks, cable transfers, or cash money. ach payment solution.

As a customer, it's most likely you're already familiar with ACH settlements, also though you could not be mindful of the jargon. If you pay your costs electronically (rather of creating a check or entering a debt click for more card number) or obtain straight deposit from your company, the ACH network is probably at work.